Whether you are a landlord or tenant, a rental ledger is a valuable tool.

A rental ledger records rent payments, late fees, security deposits, pet deposits, utility charges, maintenance, and other rental-related payments.

Your rental ledger is only helpful if you maintain it correctly and include all relevant details. Learn more about rental ledgers and how to use them in this guide with a template and examples.

Rental ledgers are a frequently used tool by landlords to record tenant payments charged to and received. However, they are also helpful for tenants to keep track of their payments. Maintaining a ledger can help renters avoid being overcharged.

For landlords, a rental ledger can offer protection if they have to evict a tenant due to non-payment of rent. It can also help with accounting and properly filing income taxes for your rental investments.

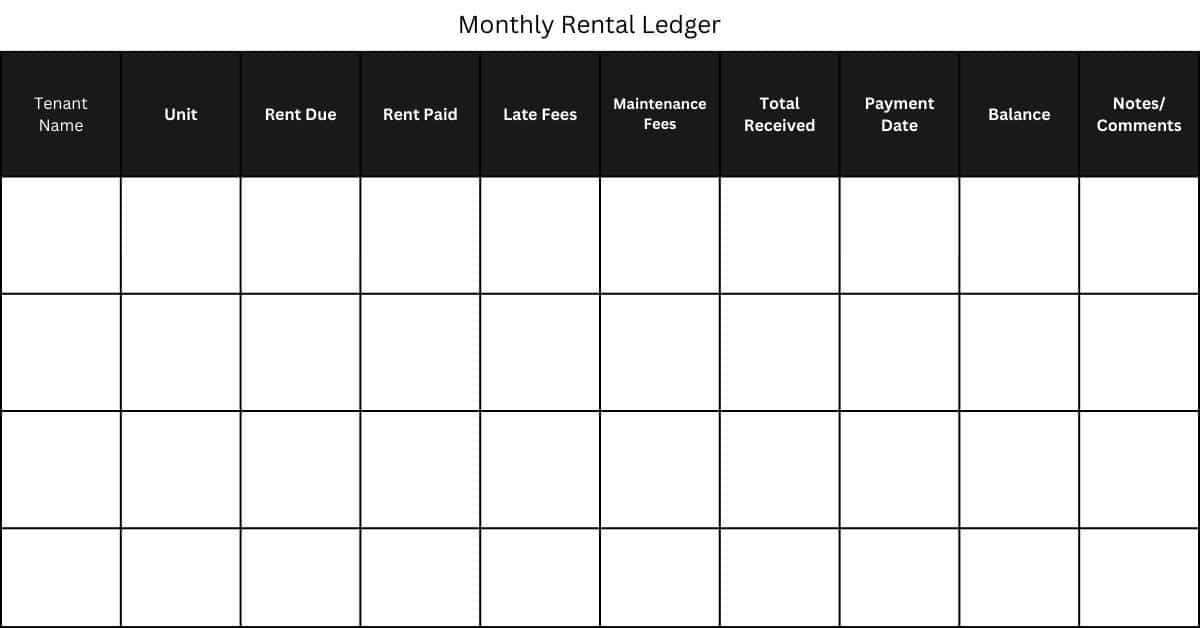

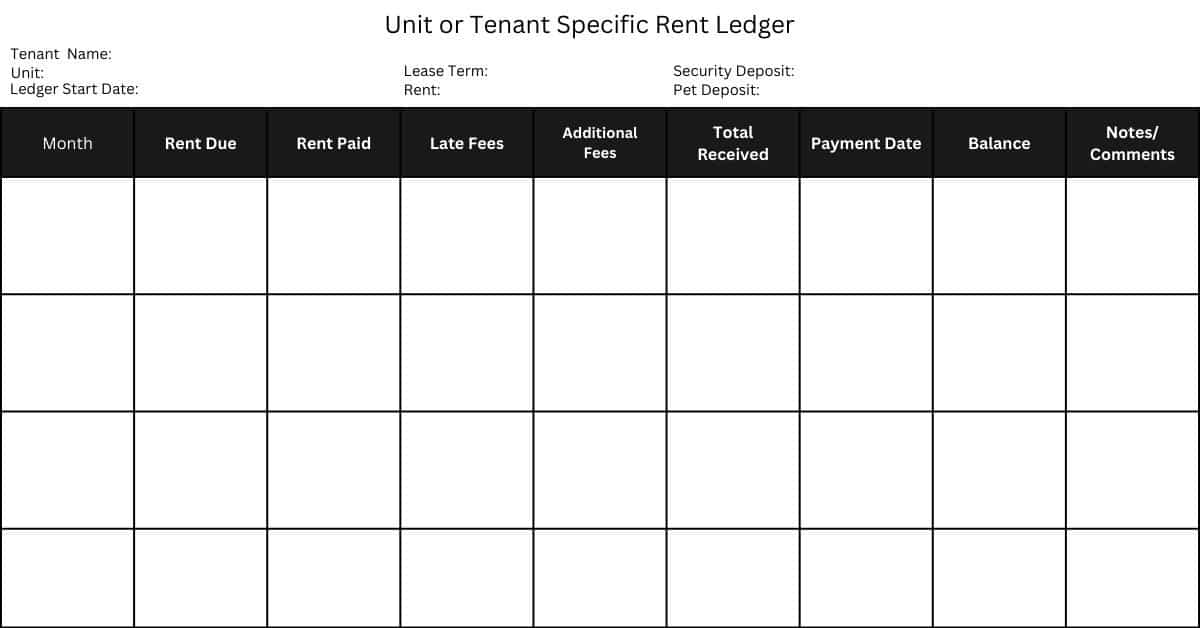

If you are looking for a rental ledger template, you can use one of the tables below.

A monthly rent ledger tracks the payments you receive from each tenant for an entire month. If you choose to track rent with a monthly ledger, you must copy over any balances owed to the ledger for the next month.

You can also choose to use a unit-specific ledger that tracks the credits and debits for each tenant throughout their lease. You can use the template below if you want to use a tenant-specific ledger.

Renters can also use this template to record monthly rent payments and charges.

Some rental assistance programs require participating property owners to maintain a ledger. When required, there is typically a specific template the agency provides.

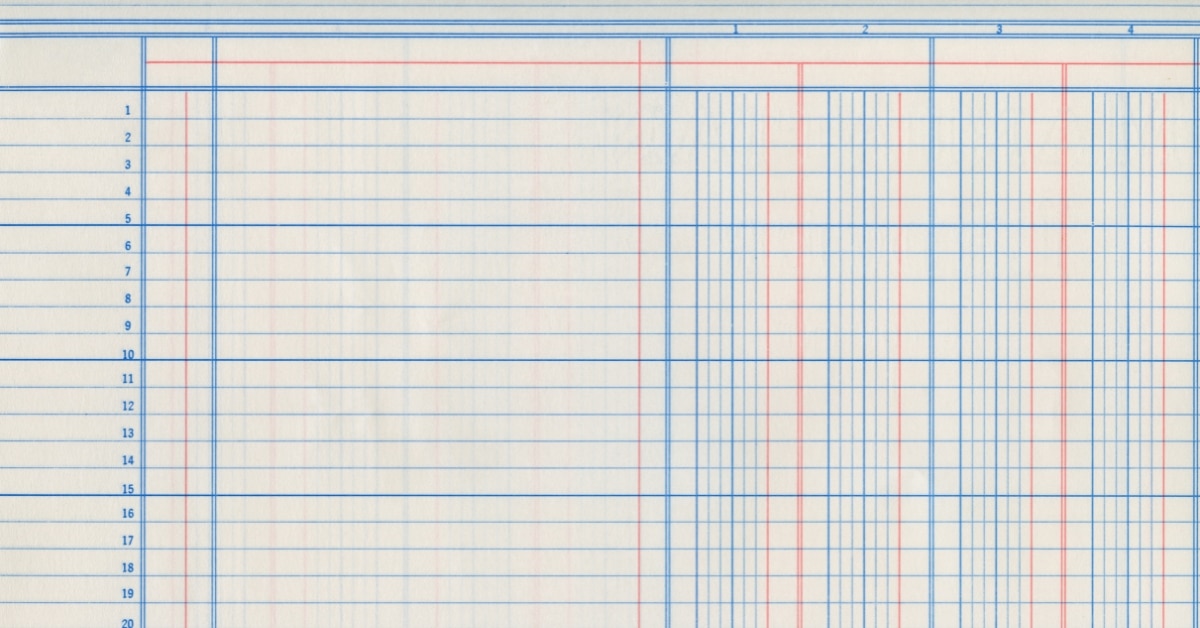

You can find general ledgers at office supply stores and online. Blank general ledgers give you space to identify each column and row. However, they require more work initially, and they can be challenging to maintain.

Nevertheless, they are an option for tracking rent. The key to successful bookkeeping with a blank ledger is properly labeling each field and filling in the data as it is available.

Your record is only beneficial if you maintain it correctly. As a landlord or property manager, you risk over or under-charging rent. Furthermore, a judge will not look favorably at you in eviction court if you provide incomplete records. So, here are a few examples of when and how to use a rental ledger.

Keeping a tenant rent ledger is more manageable than maintaining landlord records. You must include basic details about each charge and payment for your leased home. Also, be sure to include any out-of-pocket expenses you pay. It is important to record details about why you are paying these expenses and your exact terms with your landlord.

For example, if your landlord agrees to allow you to install new floors and deduct the cost from your rent, you need to include an itemized list of the expenses for the job. You would then need to credit yourself for the amount you agreed on with your landlord.

A rental ledger is an excellent way to protect yourself financially. But there are other things you should do as a tenant, like:

If you are a landlord, a rent ledger can help you track rent payments, file accurate tax returns, correctly bill tenants, and maintain positive cash flow for your rental investments. As a tenant, recording your lease payments can help avoid being overcharged.

It is beneficial to both parties during legal proceedings, as well. So, whether you are a tenant or property owner, you should maintain a rental ledger.

To learn about other rental property management topics, like how to write a rent-due notice, read the other posts on our site.

We encourage you to share this article on Twitter and Facebook. Just click those two links - you'll see why.

It's important to share the news to spread the truth. Most people won't.